does san francisco have a payroll tax

A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks. SFHSS recognizes that dental benefits are a very important part of your healthcare coverage and for maintaining your good overall health.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

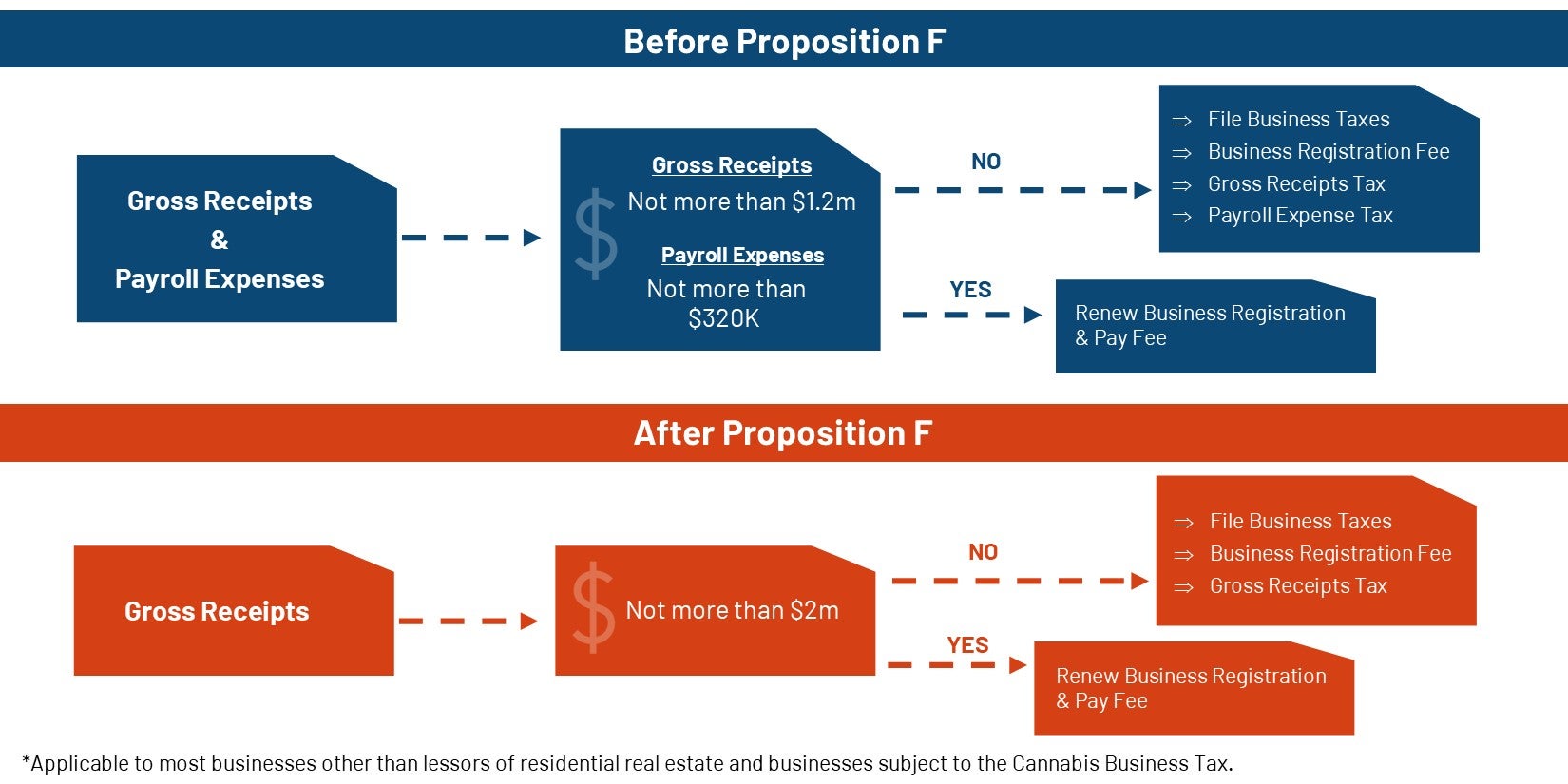

Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City.

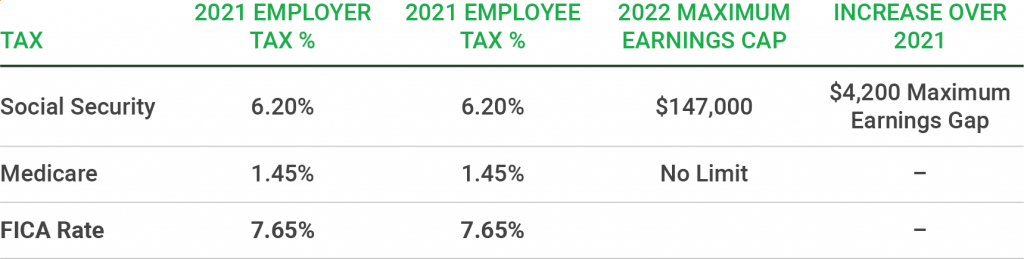

. Delta Dental PPO DeltaCare USA DHMO or UnitedHealthcare Dental DHMO. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary 2023 Free Agents. A payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security Medicare and unemployment insurance.

State Payroll Tax Rates. An updated look at the San Diego Padres 2022 payroll table including base pay bonuses options tax allocations. Player 14 League Age.

How the Bidens Dodged the Payroll Tax was Jacobs headline on Aug. Youll often find local taxes added to your employment tax requirements. Salaries from players currently in the system.

Others like Alaska Florida Nevada South Dakota Texas Washington and Wyoming dont. San Franciscos Business and Tax Regulations Code generally requires that every person engaging in business within the City regardless of whether the business or person is subject to taxation must register within 15 days after commencing business within the City. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight.

For example San Francisco Denver and Newark require employees to pay local income taxes. Payroll taxes are social insurance taxes that comprise 2305 percent of combined federal state and local government revenue the second largest source of that combined tax revenue. In it the Journal details how the Bidens set up an S-Corporation to avoid paying more than half a million.

In general businesses must register if any of the below statements are true. Denotes a buried salary that counts against the payroll. Back in August the Wall Street Journals Chris Jacobs exposed how the Biden family structured what is called an S-Corp to avoid paying hundreds of thousands of dollars in taxes.

San Francisco Giants 2022 salary cap table including breakdowns of salaries bonuses incentives cap figures dead money and more. Other states like. PPO-style dental plans like Delta Dental PPO allow.

Some states have an income tax. Consequently City County of San Francisco employees have three dental plans to choose from.

Due Dates For San Francisco Gross Receipts Tax

Judge Rules Seattle S Payroll Tax Permissible Seattle History Puget Sound Seattle

Hr Benefit Services For Small Business Tax Accountants Business Tax Payroll Taxes Career Development Plan

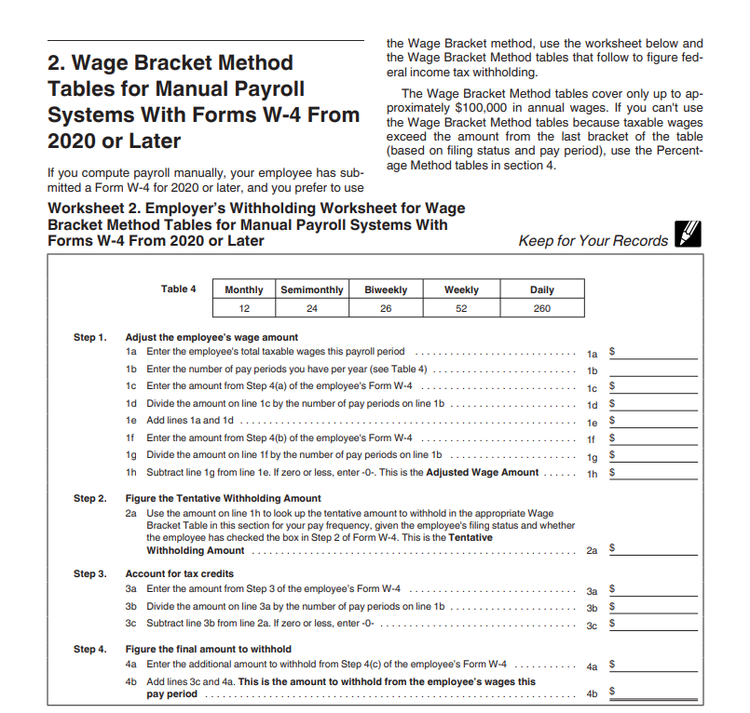

2022 Federal State Payroll Tax Rates For Employers

San Francisco Taxes Filings Due February 28 2022 Pwc

Tax Services In Houston Tax Services Payroll Taxes Tax

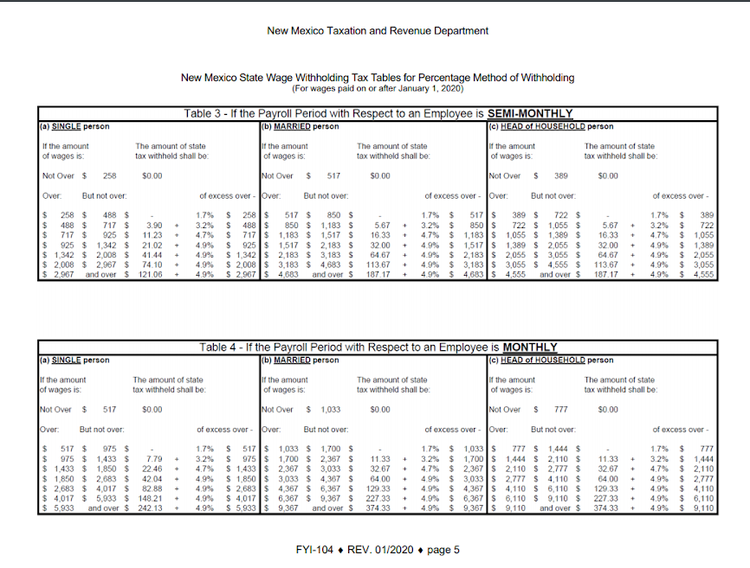

State Payroll Taxes What You Need To Know Homebase

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco S New Local Tax Effective In 2022

California Payroll Taxes Everything You Need To Know Brotman Law

20 Tax Free Countries To Get Second Residency In Las Vegas Skyline Macau

Nomersbiz Prepare A Tax Return Services In Usa Business Tax Tax Services Online Taxes

Gross Receipts Tax And Payroll Expense Tax Sfgov

2022 Federal State Payroll Tax Rates For Employers